Are you interested in buying a rural property but don’t know if you qualify for a loan under the USDA Property Eligibility?

Buying a home is an exciting time for any family, but it can be daunting if you don’t have the funds for a large down payment. Many people are looking into programs like the United States Department of Agriculture (USDA) property eligibility program.

This program provides eligible buyers and borrowers with loans that require no down payment. They offer favorable interest rates. But how do you know if you qualify?

Specific eligibility requirements need to be met to be approved for USDA financing.

This blog post will cover what you need to know to make an informed decision about your rural home purchase.

Can You Quality?

Are you wondering if you qualify for USDA Property today? The USDA sets specific requirements for eligibility.

You must meet income guidelines based on your location and household size to qualify. Your credit score should be at least 640, and you must be a U.S. citizen or have permanent residency status.

Additionally, the property you’re interested in must meet USDA guidelines for location and condition. If you meet these criteria, you could be on your way to owning a home with a USDA loan.

What Is The USDA Property Eligibility Map?

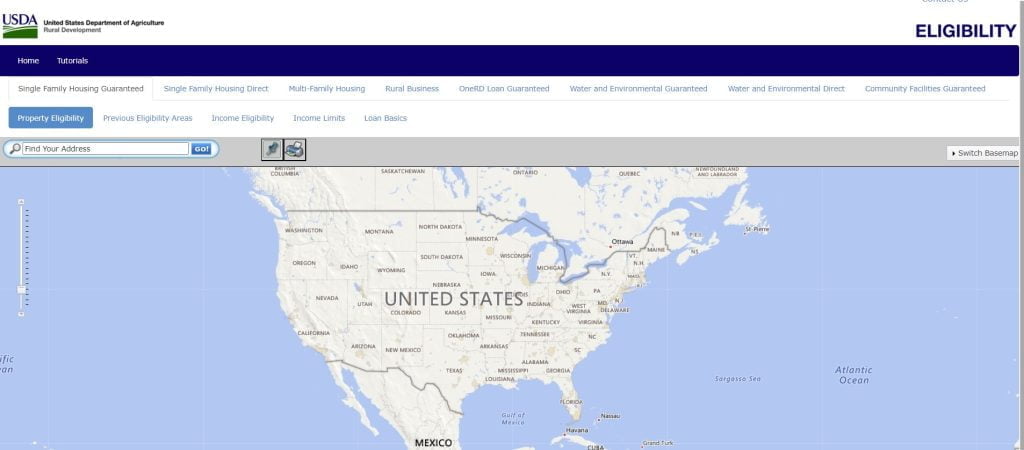

The USDA eligibility map is a tool used by the USDA to determine which areas of the country are eligible for its loan programs. The map helps potential buyers identify areas where they may qualify for a loan and shows which areas are not eligible.

However, the map is updated yearly based on population changes and other factors, so it’s essential to check it regularly to ensure you are still eligible.

Check here if your area is qualified for USDA property loans.

The USDA Property Eligibility Map is a tool that helps homebuyers determine whether a specific property is eligible for USDA financing programs. By entering an address or a general location, potential buyers can quickly see whether the property falls within a designated USDA-eligible area.

This map is crucial for individuals looking to purchase a home in rural or suburban areas and qualify for USDA loans, which offer competitive interest rates and require no down payment.

It’s straightforward to check if a property meets the USDA’s eligibility criteria, making the home-buying process more accessible for those seeking affordable financing options.

Who Qualifies For A USDA Loan?

Certain criteria must be met for a USDA loan application to qualify. The property eligibility factors begin with income limits.

The most crucial factor is USDA income eligibility: Applicants must have an annual household income at or below 115% of the median household income for the rural area where they plan to purchase a property.

Furthermore, applicants must have sufficient credit history and no debt delinquency or defaulted loans within the past 12 months.

Finally, applicants should also demonstrate the ability to repay any mortgage debt incurred during the property purchase process.

Location Requirements for USDA Property Eligibility

The first requirement is that USDA properties be located in an area deemed “rural.” To find out if your property qualifies, visit their website and do a USDA property search for your address using their eligibility site tool.

You can also contact your local USDA office for more information about eligibility in your area.

Income Eligibility Requirements

The second requirement is to meet the income requirements to qualify for these types of loans. Your total household income must not exceed 115% of the median income in your area.

The median income varies based on location and family size, so it’s essential to check with your local USDA office or visit their website to find out the median income in your area.

This information will help you determine if you fall within the acceptable income range for eligibility. Furthermore, it will help you with the applications when it is time. As you may know, living in a rural place is not always cheaper.

Credit Score Requirements

Finally, there are credit score requirements to qualify for a USDA loan program. The minimum credit score required is 620.

However, this can vary depending on other factors, such as debt-to-income ratio and whether or not you have any outstanding debts or bankruptcies.

It’s important to consider all of these factors when determining eligibility for a loan.

What Types Of Properties Qualify For A USDA Loan?

Properties must meet certain criteria related to location and type of construction to be eligible for these programs. They must also be located in rural areas, defined as any town or city with populations under 20,000.

However, it cannot be used primarily for commercial or investment purposes.

Additionally, only single-family dwellings such as detached houses or mobile homes may qualify; apartments and other multi-family dwellings do not qualify for this financing program. The residents must also be structurally sound to qualify.

These properties must be a resident’s primary residence to qualify with the property address in the USDA property eligibility map.

Designated Areas For USDA Property Eligibility

In addition, all properties purchased through this program must be located within a designated rural area as defined by the USDA’s Rural Development Office (RDO).

These areas are generally characterized by lower population density and less commercial or industrial development than urban areas, but they can also include some suburban neighborhoods.

The RDO regularly updates its list of eligible rural areas, so it’s essential to check your area’s status before applying for a loan through this property eligibility program.

Conclusion: USDA Property Eligibility Requirements

Suppose you are looking at purchasing rural property and would like assistance from the U.S. Department of Agriculture with financing costs. In that case, you must understand what qualifies you as eligible under their program guidelines.

By understanding what types of properties and incomes qualify, you can make an informed decision about whether or not you should pursue a USDA loan when buying your new home in a rural area.

Understanding how your location fits these criteria is essential if you want access to this low-cost financing option when buying rural real estate.

Once you know you qualify under the USDA property eligibility program, you can search for property.

Your Turn: USDA Property Eligibility

Before purchasing a new piece of land, check if you qualify for these lower rates. Have you applied for one of these loans to buy a rural property? I’d love to hear about your experiences in the comments below.