When unexpected events occur in remote areas of the country, having cash readily available can be crucial. That’s why many say cash is king. Especially in rural locations, access to banks and ATMs may be limited, making cash the most reliable form of currency.

Whether it’s a natural disaster, power outage, or technological malfunction, having cash on hand ensures that you can still purchase essential goods and services when other forms of payment may not be viable.

In this blog post, I will examine why cash is regaining importance in remote areas and why maintaining a cash reserve for emergencies remains essential.

I just came back from the post office, and they are only accepting cash because their internet is still down due to flooding in our area a few years ago.

Challenges of Remote Areas

Remote areas pose unique challenges when accessing financial services, particularly in times of need. Limited access to banks and ATMs in these areas can pose significant challenges for residents.

Additionally, the unreliable digital payment infrastructure further complicates financial transactions, leaving individuals with few viable options.

Moreover, the lack of financial services exacerbates residents’ difficulties, making it challenging to manage unexpected expenses effectively. These factors collectively contribute to the importance of having cash readily available in remote areas.

Limited Access to Banks and ATMs

In remote areas, the physical proximity of banks and ATMs is often limited, requiring individuals to travel long distances to reach them. This can be especially challenging during emergencies, when immediate access to cash is crucial.

Without nearby banking infrastructure, residents may find themselves unprepared to handle unexpected financial needs.

Unreliable Digital Payment Infrastructure

The digital payment infrastructure in remote areas is often unreliable, leading to issues with online transactions and electronic fund transfers. Internet connectivity challenges and technical limitations can hinder the seamless transfer of funds, leaving individuals who rely on digital payments at a disadvantage.

As a result, the reliance on cash becomes more pronounced in such areas, ensuring the availability of a universally accepted form of payment.

Lack of Financial Services in Rural Areas

The scarcity of financial services in remote areas creates a barrier to accessing essential banking and lending products. Residents may lack access to credit or insurance, further underscoring the importance of cash as a reliable financial resource.

In the absence of comprehensive financial services, cash remains a steadfast and secure means of conducting transactions and managing unforeseen financial demands.

Importance of Cash in Remote Areas

In remote areas, cash remains paramount for several reasons, including its universal acceptance and the need for immediate access in emergencies.

Universal Acceptance of Cash – Why Cash Is King

Cash is universally accepted in remote areas where digital payment infrastructures may be scarce or nonexistent. Unlike credit or debit cards, which may not be accepted in remote locations, cash ensures seamless transactions, making it the most reliable form of payment in such areas.

Emergency Situations When Cash is King

In remote areas, access to ATMs or banks can be limited, especially during natural disasters or other unforeseen emergencies.

In these ways, the universal acceptance, emergency preparedness, and cultural significance of cash underscore its unrivaled importance in remote areas.

Cash Management in Remote Areas

Cash management in remote areas presents unique challenges that require careful consideration and strategic planning.

From storing and securing cash to managing transportation and logistics, as well as budgeting and planning, effective cash management is crucial for businesses and individuals operating in these areas.

Storing and Securing Cash

In remote areas, access to banking services and electronic payment systems can be limited, requiring substantial cash on hand. However, storing cash securely is essential to mitigate the risk of theft or loss.

Utilizing secure safes, vaults, or cash management services can help protect cash from unauthorized access or weather damage.

In addition, implementing robust security measures, such as surveillance systems and trained personnel, can further safeguard stored cash.

Transportation and Logistics

The transportation of cash in remote areas requires meticulous planning and execution to ensure safe, efficient transfer. Due to the lack of banking infrastructure, businesses often need to transport cash over long distances.

Utilizing armored vehicles or professional cash-in-transit services can provide the necessary security during transportation. Moreover, establishing predetermined routes, varying travel times, and employing tracking technologies can reduce the risk of theft or interception during transit.

Budgeting and Planning

Effective budgeting and planning are fundamental to managing cash in remote areas. With limited access to financial services, maintaining adequate cash reserves is crucial to cover daily operational expenses and unexpected emergencies.

Implementing cash flow forecasting and contingency planning can help mitigate the impact of unforeseen events, such as natural disasters or supply chain disruptions. Moreover, establishing a transparent budget allocation for cash management activities enables proactive decision-making and resource allocation.

By integrating these strategies, businesses and individuals can navigate the complexities of remote cash management with confidence and resilience.

Alternatives to Cash in Remote Areas

In remote areas, access to traditional banking services and cash can be limited. However, various alternatives to cash transactions have emerged to meet the financial needs of these communities.

Mobile Money and Digital Wallets

Mobile money and digital wallets have become increasingly popular in remote areas. These solutions allow users to store and manage their money using their mobile phones.

With the widespread adoption of mobile phones, even in remote areas, mobile money provides a convenient way for individuals to conduct financial transactions without relying solely on cash.

The advantages of mobile money and digital wallets in remote areas include instant transactions, secure fund storage, and the ability to make payments without physical cash.

Additionally, these digital financial tools offer a level of convenience and security that cash may not provide in areas with limited access to traditional banking services.

However, these may not work without internet service or cell phone service, which can be a problem even in good times in rural parts of the country.

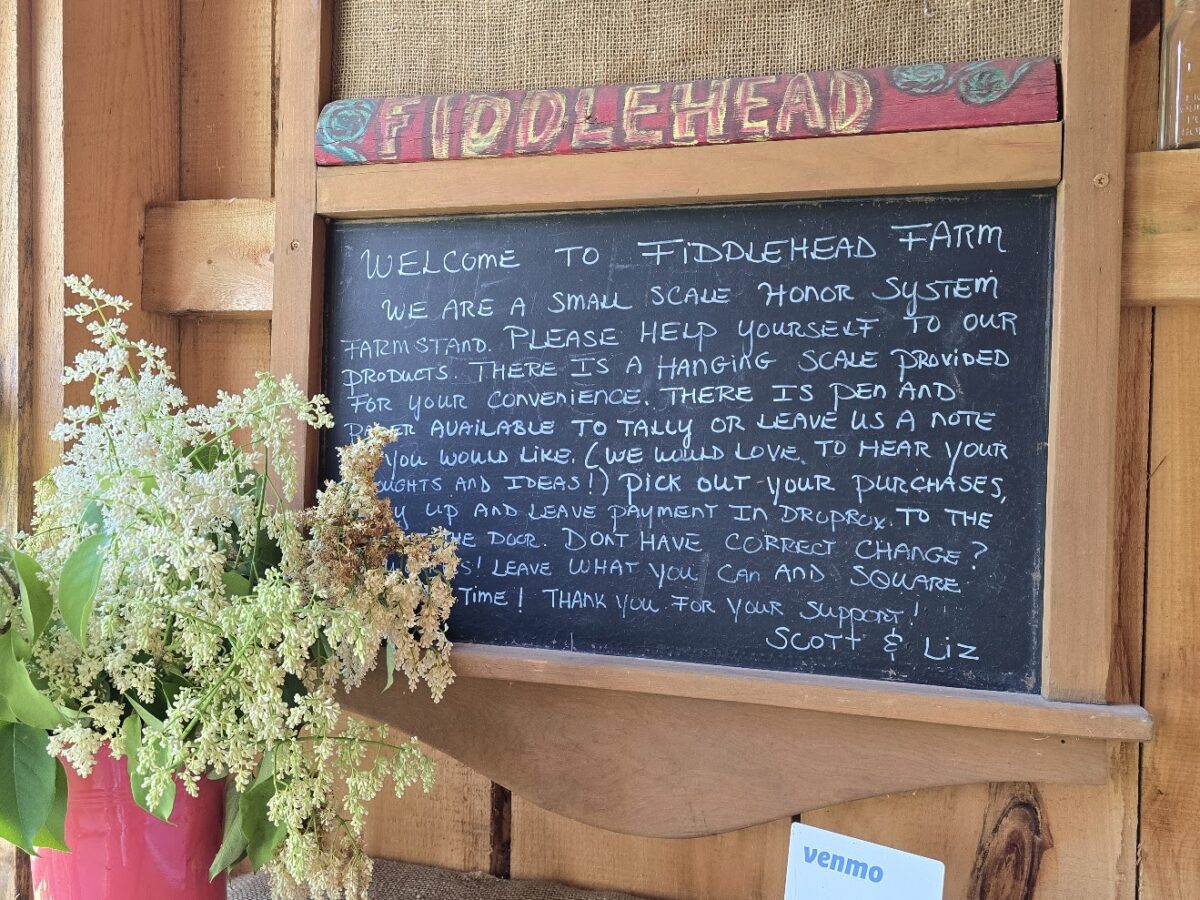

Bartering and Trade

In remote areas where cash is scarce, bartering and trade remain essential means of conducting transactions. Communities often engage in trade, exchanging goods and services without cash.

Bartering promotes interdependence and collaboration within these communities, allowing individuals to meet their needs without relying solely on monetary transactions.

Bartering also fosters a sense of community and resourcefulness, as individuals leverage their skills and resources to acquire essential goods and services.

This traditional form of commerce continues to thrive in remote areas where access to cash is limited, illustrating the resilience and adaptability of these communities in managing their economic activities.

Community-Based Financial Solutions

In the absence of traditional banking services, community-based financial solutions have emerged to address the economic needs of remote areas. These solutions often involve establishing community funds, savings groups, or rotating savings and credit associations (ROSCAs).

Community-based financial solutions enable individuals to pool their resources, create savings mechanisms, and provide access to credit within the community.

Such initiatives empower community members to support one another financially, thereby reducing their reliance on cash and formal banking institutions. These solutions exemplify the communal support and cooperation that can mitigate the challenges of cash shortages in remote areas.

Conclusion: Why Cash Is King

In rural areas of the country, having cash readily available is crucial for addressing unexpected situations. In these regions, access to ATMs or card payment facilities may be limited, making cash the most reliable form of currency.

When emergencies arise, such as power outages or natural disasters, having cash on hand can make all the difference in obtaining vital supplies and services.

Additionally, cash provides a sense of security and peace of mind, enabling individuals and businesses to navigate unforeseen challenges without being hindered by the limitations of electronic payment systems.

Therefore, in remote areas, the phrase “cash is king” holds, emphasizing the importance of having physical currency as a safeguard in uncertain circumstances.